Have you ever wondered, “What are credit scores used for?” Understanding this question isn’t just about numbers; it’s a roadmap to making informed financial decisions. In this article, we’ll break down the mysteries surrounding credit scores and explore their impact on loans, credit cards, utilities, insurance, and Renting.

Have you ever wondered, “What are credit scores used for?” Understanding this question isn’t just about numbers; it’s a roadmap to making informed financial decisions. In this article, we’ll break down the mysteries surrounding credit scores and explore their impact on loans, credit cards, utilities, insurance, and Renting.

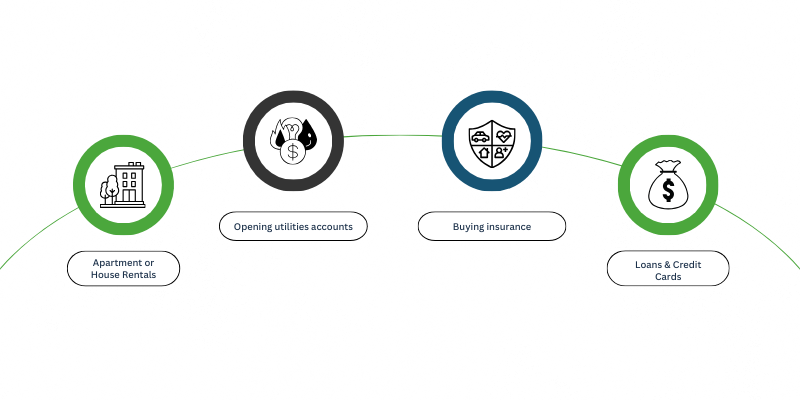

Loans & Credit Cards: Unlocking Financial Opportunities

Credit scores wield influence when seeking loans or credit cards, enabling better terms, lower interest rates, and enhanced borrowing capacity. Your credit score acts as the gateway to diverse financial opportunities, from dream home mortgages to rewarding credit cards.

Opening Utilities Accounts: A Smooth Transition to Your New Home

Moving? Setting up utilities with a positive credit history can save you from hefty deposits, ensuring a hassle-free transition to your new home.According to the Federal Trade Commision,” Companies will look at your credit history. Like other creditors, utility companies will ask for information like your Social Security number so they can check your credit history. A good credit history can make it easier for you to get services.

Buying Insurance:A Financial Safety Net

Similar to loans, credit scores affect insurance rates. Insurers use your credit history to assess risk, impacting insurance premiums. Maintaining a positive credit history leads to long-term savings, whether insuring a vehicle or safeguarding your home, and most importantly, your health.

Apartment or House Rentals: Navigating the Rental Landscape

In the competitive rental market, your credit score speaks volumes. Landlords use it to gauge tenant reliability, making a positive credit history a differentiator. Understanding credit scores in the rental process enhances your chances of securing your desired home.

Bottom Line: Empowering Your Financial Journey

Understanding credit scores is more than surface-level—it’s about financial empowerment. From loans and utilities to insurance and finding a home, your credit score is a valuable ally. Armed with this knowledge, you’re well-prepared for a brighter financial future.

Are you ready to start improving your credit? Contact us today.